On June 22, 2011, the Securities and Exchange Commission (the “SEC” or the “Commission”) voted to adopt final rules[1] to implement amendments to the Investment Advisers Act of 1940 (the “Advisers Act”) contained in Title IV of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”).[2]

Importantly, the Commission extended from July 21, 2011 to March 30, 2012 the deadline for registration for private fund advisers previously exempt under Section 203(b)(3) of the Advisers Act, which exempted from SEC registration investment advisers with fewer than 15 clients.

As a result of this extension, the revised compliance dates generally applicable to investment advisers having to register for the first time are as follows:

| Date | Action |

| January 2, 2012 | First day that mid-sized advisers registered with the SEC as of July 21, 2011 may withdraw from SEC registration, absent an exemption. |

| February 14, 2012 | Last day for filing Form ADV with SEC to allow 45 days prior to effective date. Code of Ethics and compliance policies should be complete. |

| March 30, 2012 | Deadline for:

1. Form ADVs of private fund advisers relying on the exemption provided under Section 203(b)(3) as of July 21, 2011 to be declared effective by the SEC; 2. advisers registered as of January 1, 2012 to file amended Form ADV; and 3. “exempt reporting advisers” to file Part 1A of Form ADV. |

| June 28, 2012 | Deadline for mid-size advisers to withdraw from SEC registration; provided that relevant state has adequate regulatory scheme. |

The final rules can be broken down into three main categories. First, the rules address the exemptions from registration enacted in Dodd-Frank in connection with Dodd-Frank’s repeal of Section 203(b)(3) of the Advisers Act. Second, the rules address provisions of Dodd-Frank that delegate responsibility for mid-sized investment advisers away from the Commission to state regulatory authorities. Third, the Commission adopted amendments to Form ADV to reflect the new registration requirements.

I. New Exemptions

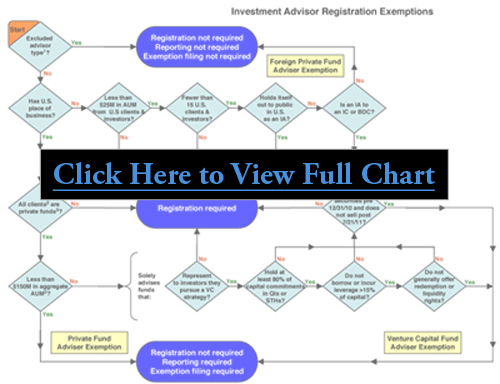

The Commission’s rules relate to four exemptions from registration under the Advisers Act: (a) an exemption for advisers to venture capital funds (the “venture capital fund exemption”); (b) an exemption for advisers to private funds[3] with less than $150 million in private fund assets under management (the “private fund adviser exemption”); (c) an exemption for certain foreign advisers with less than $25 million in assets under management attributable to U.S. investors and clients (the “foreign private adviser exemption”); and (d) an exemption for family offices (the “family office exemption”).[4] Seethe attached diagram depicting the availability of exemptions.

A. Venture Capital Fund Exemption

This exemption is available if the investment adviser advises only private funds, which either meet the definition of “venture capital fund” or qualify under a grandfathering provision. Rule 203(l)-1 defines a “venture capital fund” as a private fund that:

(1) holds no more than 20 percent of its capital commitments in non-qualifying investments (other than cash or cash equivalents) immediately after the acquisition of any asset (other than qualifying investments or cash or cash equivalents);

(2) does not borrow or otherwise incur leverage in excess of 15% of its capital commitments, subject to certain exceptions;

(3) does not offer its investors redemption or other similar liquidity rights except in extraordinary circumstances;

(4) represents to investors and potential investors that it pursues a venture capital strategy; and

(5) is not registered under the 1940 Act and has not elected to be treated as a business development company.

1. Holding Requirements

In a significant change from the proposed rules, the final rules provide that a fund can still be considered a venture capital fund even if it invests up to 20 percent of its capital in “non-qualifying” investments. This change is intended to provide advisers to venture capital funds with greater investment flexibility while still precluding an adviser relying on the exemption from altering the character of the fund’s investments to such an extent that the fund could no longer be viewed as a venture capital fund.

For purposes of the venture capital fund exemption, the advised fund must hold, immediately after the acquisition of any asset (other than qualifying investments or cash or cash equivalents), no more than 20 percent of its capital commitments in non-qualifying investments (other than cash or cash equivalents) valued at historical cost or fair value, as determined by the fund adviser but consistently applied. The SEC specified that a fund need only calculate the 20 percent limit when it acquires a non-qualifying investment, and that after the acquisition the fund need not dispose of a non-qualifying investment simply because of a change in the value of the fund’s investments. The fund may be precluded from acquiring additional non-qualifying investments until the value of its then-existing non-qualifying investments falls below 20 percent of its committed capital.

a. Qualifying Investments

“Qualifying investment” means any equity security issued by a qualifying portfolio company that is directly acquired by the private fund from the company (“directly acquired equity”). In addition, any equity security issued by a qualifying portfolio company in exchange for directly acquired equity issued by the same qualifying portfolio company, and any equity security issued by a company of which a qualifying portfolio company is a majority-owned subsidiary or a predecessor that is acquired by the fund in exchange for directly acquired equity, is also a qualifying investment.

The following are not qualifying investments and therefore would count toward the 20 percent basket: non-equity securities, shares acquired in an initial public offering or shares acquired in a secondary transaction from existing holders.

b. Qualifying Portfolio Company

“Qualifying portfolio company” means any company that (i) at the time of an investment by a qualifying fund, is not a reporting or foreign traded company (i.e., is not subject to the reporting requirements of Sections 13 or 15(d) of the 1934 Act and does not have any publicly traded securities) and does not have a control relationship with a reporting or foreign traded company; (ii) does not incur leverage in connection with the investment by the private fund and distribute the proceeds of any such borrowing to the private fund in exchange for the private fund investment[5]; and (iii) is not itself a fund (i.e., is an operating company). Under the rule, a venture capital fund may continue to treat as a qualifying portfolio company any qualifying portfolio company that subsequently becomes a reporting company.

2. Leverage Limitations

The venture capital fund cannot borrow, issue debt obligations, provide guarantees or otherwise incur leverage in excess of 15 percent of the fund’s capital commitments, and any such borrowing, indebtedness, guarantee or leverage must be for a non-renewable term of no longer than 120 calendar days, except that a guarantee of a qualifying portfolio company’s obligations, up to the value of the private fund’s investment in the qualifying portfolio company, is not subject to the 120-calendar-day limit.

3. No Redemption or Similar Liquidity Rights

The venture capital fund cannot issue securities that provide investors with redemption, withdrawal or similar “opt-out” rights, except in “extraordinary circumstances.” A material change in tax law after an investor invests in the fund or the enactment of laws that may prohibit an investor’s participation in the fund’s investment in particular countries or industries would each be considered an “extraordinary circumstance.” Similarly, customary withdrawal provisions for investors subject to the Employee Retirement Income Security Act of 1974 or subject to the Bank Holding Company Act of 1956 would likely qualify for the “extraordinary circumstances” exception.

4. Represents Itself as Pursuing a Venture Capital Strategy

The venture capital fund must represent to investors and potential investors that it pursues a venture capital strategy. Whether or not a fund meets this requirement will depend on the particular facts and circumstances of the statements made by the fund. A qualifying fund need not use the words “venture capital” as part of its name. The appropriate framework for analyzing whether a qualifying fund has satisfied this holding out criterion depends on the statements (and omissions) made by the fund to its investors and prospective investors.

5. Application to Non-U.S. Advisers

A non-U.S. adviser may rely on the venture capital fund exemption, but only if all of its clients, whether U.S. or non-U.S., are venture capital funds under the rule or the grandfathering provision.

6. Grandfathering

The SEC grandfathered advisers to existing private funds that would not meet all of these requirements but represented to investors and potential investors at the time the fund offered its securities that it pursues a venture capital strategy. In order to be grandfathered, the existing fund must have sold securities to one or more investors prior to December 31, 2010 and must not sell any securities to any person after July 21, 2011 (but can call for capital contributions thereafter).

B. Private Fund Adviser Exemption

The SEC adopted rules relating to an exemption from registration under Dodd-Frank for advisers solely to private funds with less than $150 million of aggregate regulatory assets under management (“regulatory AUM”) in the United States. In order to qualify for this exemption, advisers can advise an unlimited number of private funds, provided that the aggregate regulatory AUM of the private funds is less than $150 million.

Rule 203(m)-1 requires advisers to calculate the value of regulatory AUM pursuant to instructions in Form ADV, which provide a uniform method of calculating regulatory AUM for the purposes of the Advisers Act. Regulatory AUM is determined by calculating the “securities portfolios with respect to which an investment adviser provides continuous and regular supervisory or management services,” as described in the Form ADV instructions. The instructions also specify that advisers must include in their calculations proprietary assets and assets managed without compensation as well as uncalled capital commitments. An adviser must determine the amount of its regulatory AUM based on the market value of those assets (or the fair value if market value is unavailable) and must calculate the assets on a gross basis (i.e., without deducting liabilities).

An adviser relying on the private fund adviser exemption must annually calculate the amount of regulatory AUM and report the amount in its annual updating amendment to its Form ADV. Advisers may be required to register under the Advisers Act as a result of increases in their regulatory AUM that occur from year to year, but changes in the amount of an adviser’s regulatory AUM between annual updating amendments will not affect the availability of the exemption.

1. Distinction Between U.S. Advisers and Non-U.S. Advisers

Under Rule 203(m)-1, advisers with a principal office and “place of business” in the United States must count private fund assets managed at a place of business outside of the United States toward the $150 million regulatory AUM limit. The private fund adviser exemption is available to an adviser with a principal office and place of business outside of the United States as long as all of the adviser’s clients that are U.S. persons are private funds and have aggregate regulatory AUM of less than $150 million. Note that a non-U.S. adviser may not rely on the exemption if it has any client that is a U.S. person other than a private fund.

For this purpose, “place of business” means any office where an investment adviser regularly provides advisory services, solicits, meets with, or otherwise communicates with clients, and any location held out to the public as a place where the investment adviser conducts any such activities. Under the rule, an adviser must determine whether it has a place of business in the United States in light of the relevant facts and circumstances. A place of business would not include an office where an adviser solely performs administrative services and back-office activities if such activities are not intrinsic to providing investment advisory services and do not involve communicating with clients.

2. Transition Period

A previously exempt private fund adviser that reports in an annual updating amendment to its Form ADV that it has $150 million or more of regulatory AUM will have 90 days after filing the amendment to apply for registration if it has complied with all SEC reporting requirements applicable to exempt advisers.

C. Foreign Private Adviser Exemption

The SEC also approved final rules implementing the exemption from registration of foreign private advisers. The exemption applies to any investment adviser that:

(1) has no “place of business” in the United States (as described above);

(2) has, in total, fewer than 15 clients in the United States and investors in the United States in private funds advised by the investment adviser;

(3) has aggregate regulatory AUM attributable to clients in the United States and investors in the United States in private funds advised by the investment adviser of less than $25 million;

(4) does not hold itself out generally to the public in the United States as an investment adviser; and

(5) does not advise a U.S.-registered fund or a business development company.

1. Counting Clients

For purposes of counting clients for the foreign private adviser exemption, the final rules largely mirror the previous rules regarding counting clients for the repealed “fewer than 15 clients” exemption. As proposed, non-U.S advisers must count as a client any person for whom the adviser provides investment advisory services whether or not the adviser receives compensation from such client.

2. Investor

“Investor” in a private fund means any person who would be included in determining the number of beneficial owners of the outstanding securities of a private fund under Section 3(c)(1) of the 1940 Act, or whether the outstanding securities of a private fund are owned exclusively by qualified purchasers under Section 3(c)(7) of the 1940 Act. A beneficial owner of short-term paper issued by the private fund also is also considered an “investor.”

3. In the United States

The final rules define “U.S. person” generally by incorporating the definition of “U.S. person” in Regulation S under the Securities Act of 1933.[6]

D. Family Office Exemption

The SEC approved the final rule exempting family offices from registration. Historically, many family offices were not required to register because of the repealed “fewer than 15 clients” exemption and other SEC guidance.

The final rule defines “family office” as an entity that: (1) has no clients other than family clients; (2) is wholly owned by family clients and is exclusively controlled (directly or indirectly) by one or more family members and/or family entities; and (3) does not hold itself out to the public as an investment adviser. An adviser controlled by employees who are not family members would not qualify as a family office under the rule.

In response to comments, the SEC expanded the definition of family members and family clients originally included in the proposed rules, providing family offices relying on the registration exemption more flexibility in structuring their operations.

1. Family Client

“Family client” means (a) current and former family members; (b) current key employees of the family office (and, in some circumstances, former key employees); (c) charities funded exclusively by family clients; (d) estates of current and former family members or key employees of the family office (and, in some circumstances, of former key employees); (e) irrevocable trusts existing for the sole current benefit of family clients or, if both family clients and charitable and nonprofit organizations are the sole current beneficiaries, trusts funded solely by family clients; (f) revocable trusts in which one or more other family clients are the sole grantors; (g) trusts solely funded and controlled by key employees; and (h) companies wholly owned and operated for the sole benefit of one or more family clients.

2. Family Members

“Family members” means all lineal descendants (including by adoption, stepchildren, foster children, and in some cases, legal guardianship) of a common ancestor (who may be living or deceased), as well as current and former spouses or spousal equivalents of those descendants, provided that the common ancestor is no more than 10 generations removed from the youngest generation of family members.[7]

3. Key Employees

“Key employees” means the following individuals (including any such individual’s spouse or spousal equivalent who holds a joint, community property or other similar shared ownership interest with that individual): (i) executive officers, directors, trustees, general partners, or persons serving in a similar capacity for the family office or its affiliated family office; and (ii) any other employee of the family office or its affiliated family office (other than a clerical or secretarial employee) who, in connection with his or her regular duties, has participated in the investment activities of the family office or affiliated family office or similar functions or duties for the entity for at least 12 months. “Affiliated family office” is defined as a family office wholly owned by family clients of another family office and that is controlled (directly or indirectly) by one or more family members of such other family office and/or family entities affiliated with such other family office and has no clients other than family clients of such other family office.

4. Transition Period

The final rule provides that family offices formerly exempt from registration in reliance on the repealed “fewer than 15 clients” exemption that do not qualify under the new exemption are not required to register with the Commission as investment advisers until March 30, 2012.

II. Mid-Sized Advisers

Previously under the Advisers Act, investment advisers that are subject to registration in the state in which they maintain their principal office and place of business are prohibited from registering with the Commission if they have less than $25 million of assets under management, with some exceptions. Section 410 of Dodd-Frank increases this threshold, effectively creating a new prohibition from registration for so-called “mid-sized advisers” and shifting the responsibility for regulatory oversight of these mid-sized advisers to the states. Mid-sized advisers are those with between $25 million and $100 million of regulatory AUM.[8]

Despite the new rule, mid-sized advisers will still be required to register with the Commission in the following circumstances: (a) if the adviser is not required to register as an investment adviser with the state securities authority in which it maintains its principal office and place of business; or (b) if, even though it is registered with the state, the investment adviser is not subject to examination as an investment adviser by the state securities authority. Based on the Commission’s discussions with state securities authorities, mid-sized advisers with their principal office and place of business in Minnesota, New York or Wyoming are not subject to examination by the state securities authority and, as such, will be required to register with the Commission even if their regulatory AUM is between $25 million and $100 million. (Advisers with less than $25 million of regulatory AUM will continue to be subject solely to state regulation.)

The Commission, persuaded by several comments received during the comment period, created a buffer so that advisers will not have to switch between federal and state registration due to market volatility. Amended Rule 203(A)-1(a)(1) provides that advisers with regulatory AUM of at least $100 million but less than $110 million may, but are not required to, register with the Commission. Similarly, advisers that are registered with the Commission will not be required to withdraw their registration unless their regulatory AUM drops below $90 million.

III. Filing and Reporting Requirements

A. Exempt Reporting Advisers

Although advisers who rely on the venture capital fund exemption or the private fund adviser exemption (i.e., “exempt reporting advisers”) will not be required to register with the SEC, they, along with registered advisers, will be subject to certain reporting requirements. Under the new rules, exempt reporting advisers will be required to file and periodically update abbreviated reports with the SEC, using the same Form ADV that registered advisers file with the SEC.

However, rather than completing all the items on Form ADV, exempt reporting advisers will only be required to fill out a limited subset of the items in Part 1A of Form ADV, including:

- basic identifying information for the exempt reporting adviser and the identity of its owners and affiliates;

- information about the private funds the exempt reporting adviser advises and about other business activities that the exempt reporting adviser and its related persons are engaged in that present conflicts of interest that may suggest significant risk to clients; and

- the disciplinary history (if any) of the exempt reporting adviser and its advisory affiliates that may reflect on the integrity of the firm.

Exempt reporting advisers will not be required to prepare a brochure or brochure supplements under Part 2A or 2B, respectively, of Form ADV.

As with registered investment advisers, exempt reporting advisers will file their reports on the SEC’s investment adviser electronic filing system (“IARD”), using the same process as registered advisers. These reports will be available to the public on the SEC’s website. An exempt reporting adviser must submit its initial Form ADV within 60 days of relying on either the venture capital fund exemption or the private fund adviser exemption. Thereafter, exempt reporting advisers must amend their reports on Form ADV (a) at least annually, within 90 days of the end of such adviser’s fiscal year; and (b) more frequently, if certain information becomes inaccurate.

Exempt reporting advisers will also be subject to recordkeeping rules that the SEC will adopt in the future and limited SEC examination oversight, although SEC Chairman Schapiro has stated that the SEC does not intend to conduct routine examinations of exempt reporting advisers.

B. Amendments to Form ADV

Investment advisers registering with the SEC are required to electronically file with the SEC a disclosure document (Form ADV) and periodic amendments thereto. For a general description of the investment adviser registration process, please refer to our previous client alert on the subject, which is available at www.gibsondunn.com/publications.

The new rules adopted by the SEC on June 22 include amendments to Part 1A of Form ADV and the related Schedules, which the SEC expects will be updated on the IARD system and available for filing with the SEC by January 1, 2012. Under Rule 203A-5, all investment advisers that are registered with the Commission on January 1, 2012 will be required to file an amendment to Form ADV no later than March 30, 2012. Those advisers that are prepared to file in fall of 2011, but that qualify for an exemption from registration until March 30, 2012, may wish to consider delaying registration until after January 1, 2012 in order to avoid having to file both the registration and the update within such a short period of time. The substantive changes to Part 1A of Form ADV include the following:

- Private Fund Reporting. Registered advisers and exempt reporting advisers will be required to report to the SEC information regarding the private funds that they advise.[9] Such information includes information regarding the private fund’s structure, investment strategy and ownership, the private fund’s gross asset value and the services provided by the adviser to the private fund and the private fund’s “gatekeepers” (i.e., its auditors, prime brokers, custodians, administrators and marketers).[10]

- Advisory Business and Conflicts. Registered advisers will be required to, among other things, indicate how many of its employees are investment adviser representatives or licensed insurance agents and to report the number and types of clients the adviser services (including the approximate percentage of assets under management attributable to each client type).

- Non-Advisory Activities and Financial Industry Affiliations. Registered advisers and exempt reporting advisers will be required to report additional information regarding their relationships with certain related persons.

C. Withdrawal of Registration

Under Rule 203A-5, each adviser that is registered with the Commission on January 1, 2012, regardless of size, is required to file an amendment to its Form ADV no later than March 30, 2012 which responds to the new items in the form and identifies those advisers no longer eligible to register with the Commission. Mid-sized advisers that are no longer eligible to register with the Commission must withdraw their registrations by filing a Form ADV-W no later than June 28, 2012. The withdrawal must be filed after filing the Form ADV amendment with the Commission.

IV. Subadvisory Relationships and Advisory Affiliates

In addition to the new exemptions, the SEC provided guidance as to how the new exemptions would apply to subadvisers. The SEC generally interprets advisers as including subadvisers and, therefore, subadvisers may rely on these new exemptions, provided that they satisfy all the terms and conditions of the applicable exemption.

Furthermore, in determining whether an adviser can avail itself of an exemption from registration, the SEC indicated that it would treat as a single adviser two or more affiliated advisers that are separately organized but operationally integrated. Whether an adviser affiliate is operationally integrated is a facts and circumstances determination based on various factors.

When considering the relationship between a registered U.S. adviser and a non-U.S. based advisory affiliate (often termed a “participating affiliate”), the SEC clarified that it has not withdrawn the Unibanco line of no-action letters, which was developed in the context of the “fewer than 15 clients” exemption. In these letters, the SEC staff provided assurances that it would not recommend enforcement action (a) to apply the substantive provisions of the Advisers Act to a non-U.S.-based adviser’s relationship with its non-U.S. clients, or (b) against a non-U.S. unregistered adviser that is affiliated with a registered adviser, despite sharing personnel and resources where: (1) the advisers are separately organized; (2) the registered affiliate is staffed with personnel capable of providing investment advice; (3) all personnel of the unregistered non-U.S. adviser involved in U.S. advisory activities are deemed associated persons of the registered affiliate; and (4) the SEC has adequate access to trading and other records of the unregistered non-U.S. adviser and to its personnel to the extent necessary to enable it to identify conduct that may harm U.S. clients or markets.

V. Conclusion

The SEC has redrawn the line at March 30, 2012 for private fund adviser registration. Accordingly, advisers will want to review their readiness for SEC (or state) registration and use the remainder of calendar year 2011 to prepare to operate as regulated entities. In addition to finalizing and filing their Form ADVs, investment advisers will need to review, finalize and implement their Codes of Ethics and compliance procedures. Among other things, an adviser facing registration for the first time should:

- Conduct a final review of its Form ADV, Code of Ethics and compliance procedures to make sure they reflect the adviser’s current business, organizational structure and personnel;

- Verify accuracy, completeness and consistency of disclosures across documents, including private placement memoranda and Form ADV;

- Test run compliance procedures to make sure that they are workable in real time;

- Review supervisory processes to make sure that all responsible personnel understand their obligations and are ready to assume those duties;

- Inventory conflicts of interest and processes for ongoing identification, disclosure and management of conflicts;

- Confirm that background information for personnel is current and that all required information regarding outside activities, personal trading and political contributions has been obtained and is current;

- Institute an initial and periodic training program for their personnel to sensitize them to the adviser’s compliance procedures and obligations; and

- Encourage all personnel to be part of the adviser’s compliance program.

[1] The SEC issued three releases on June 22: (i) Exemptions for Advisers to Venture Capital Funds, Private Fund Advisers With Less Than $150 Million in Assets Under Management, and Foreign Private Advisers; (ii) Rules Implementing Amendments to the Investment Advisers Act of 1940; and (iii) Family Offices.

[2] Pub.L 111-203, H.R. 4173.

[3] Generally, a private fund is a hedge fund, private equity fund or other investment vehicle that is excluded from the definition of investment company under the Investment Company Act of 1940 (the “1940 Act”) by reason of section 3(c)(1) or 3(c)(7) of the 1940 Act.

[4] The Commission also adopted amendments to three of the exemptions found in Rule 203A-2. First, the exemption from the prohibition on Commission registration for nationally recognized statistical ratings organizations was eliminated, as those organizations have a separate regulatory regime provided under the Securities Exchange Act of 1934 (the “1934 Act”). Second, the exemption available to pension consultants was amended to increase the minimum value of assets required to rely on the exemption from $50 million to $200 million. Finally, the Commission amended Rule 203A-2(d), which had previously permitted investment advisers required to register with 30 or more states to register instead with the Commission. The rule now permits all investment advisers required to register with 15 or more states to register instead with the Commission.

[5] Although qualifying portfolio companies may borrow in the ordinary course of business, they may not borrow “in connection with” a venture capital fund investment and distribute the proceeds of such borrowing or issuance to the venture capital fund “in exchange for” the fund’s investment. The language of the rule was intended to distinguish the buyout of existing investors using borrowed money, which would not be a qualifying portfolio company, but appears to be more applicable to a leveraged recapitalization.

[6] See 17 CFR 230.902(k).

[7] The SEC eliminated the concept of a “founder” from the proposed rule, which defined the founder as the “natural person and his or her spouse or spousal equivalent for whose benefit the family office was established and any subsequent spouse of such individuals.”

[8] The SEC rescinded the safe harbor previously provided by Advisers Act Rule 203A-4 for an investment adviser that is registered with a state securities authority based on a reasonable belief that it does not meet the threshold amount of assets under management.

[9] To avoid duplicative reporting and to minimize the overall burden of private fund reporting: (a) only one adviser is required to report the information regarding a private fund that is advised by more than one person (e.g., where there is a co-manager, subadviser or trading adviser), and (b) an adviser advising a master-feeder arrangement may submit a single report for the master fund and all of the feeder funds if the funds would otherwise report substantially identical information.

[10] The SEC had proposed but did not adopt amendments that would have required an adviser: (a) to disclose the net assets of each private fund, (b) to report private fund assets and liabilities by class and categorization in the fair value hierarchy established under GAAP, and (c) to specify the percentage of each private fund owned by particular types of beneficial owners.